Maintaining a yearly and monthly budget changed my life and helped me prepare for my future financially. It can do the same for you.

2020 is upon us and while it marks the beginning of a new decade, it can also mark the last year you don’t set your budget intentions for the year.

So that there is no confusion, I’m going to break down the process I use to set my budget intentions and why it’s useful. Then, I’m going to provide you with a FREE 2020 budget template to use.

WHAT IS A BUDGET?

A budget is an estimate of income and expenses for a period of time. You can choose to have a daily, weekly, monthly, or yearly budget. I like to have a yearly budget to set my intentions and a monthly budget to track my actual spending.

Before I had a solid budget, I’d get to the end of the month and wonder where all my money had gone. Has this happened to you?

Having a budget allows me to plan how to spend money in advance and gives me clarity on where I want to focus my short-term and long-term intentions.

WHAT ARE BUDGET INTENTIONS?

When I use the phrase budget intentions, I’m referring to the plans I have for my earnings and spending each month.

HOW DO YOU SET YOUR INTENTIONS?

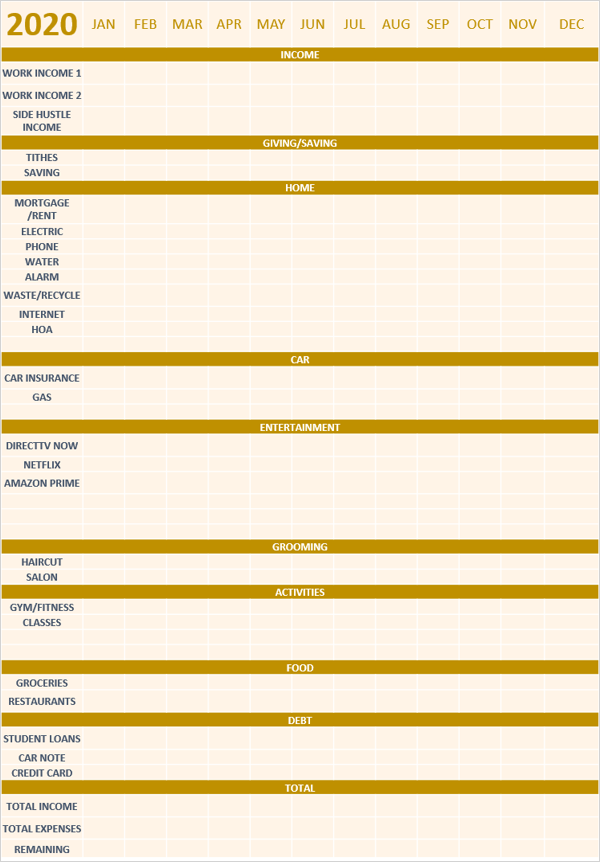

I use a budget spreadsheet and a budget template works well too. I do this because I like to see the every expense in one worksheet. Take a look.

I’ll walk you through how to complete this budgeting spreadsheet.

INCOME INTENTIONS/PROJECTIONS

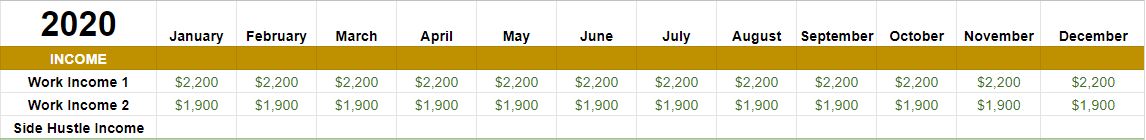

If you have a salary position, you know your exact base monthly income. You can use this information to complete a full year of base income intentions, isn’t that exciting?!

I chose to fill in the first row with an arbitrary value but you get the point. But now with one glance, if you earn $22oo a month, you know that your base yearly income expectations is $26,400.00 or 2200*12.

If you have an additional job or a partner, their income can be added to the next row.

I also like to include a row for a side hustle income because we all have more than one skill that can be monetized and I like to have that row as a reminder that our income isn’t limited.

Now. You may be thinking that if you don’t have a salary position, this will not work for you but that’s not true.

I spent a few years working in retail and I had friends who worked in the restaurant industry so tips were a large part of their earnings. You may even work within a service-based industry and it’s difficult to know how many clients you’ll have. If this is your situation, here are a few suggestions:

-

-

- Use an average of your last year’s monthly earning.

- Use the lowest possible income value. If you know you’ll have a minimum of 20 hours, use that to calculate your monthly income.

-

This isn’t an exact science just educated guessing and guess what? Life will happen and you’ll need to adjust as you go along because job separation, bonuses, and raises happen.

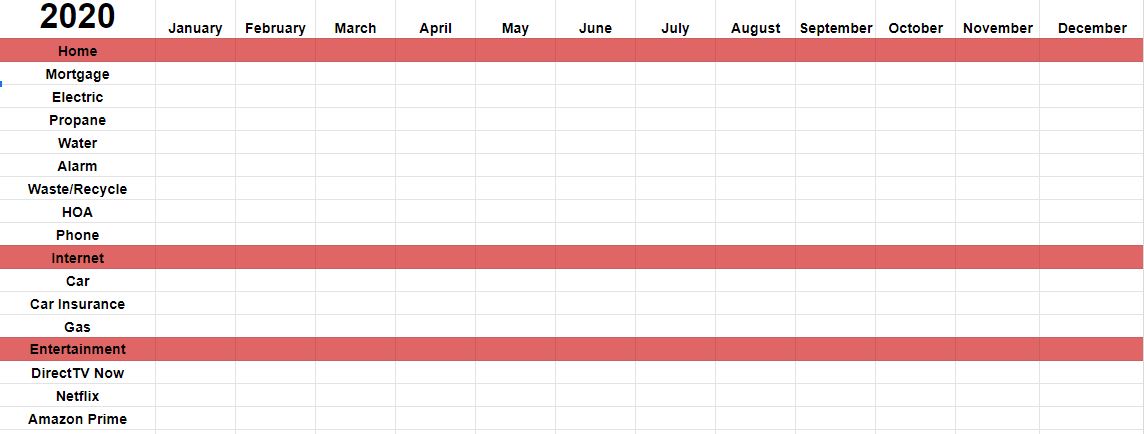

EXPENSES INTENTIONS/PROJECTIONS

Once you’ve filled in your expected income, it time to fill in your expenses.

I used to find this to be the not so fun part but now I like to practice gratitude as I complete each of the columns because I know that it’s a privilege to be able to pay the water bill and have water flowing through my faucet at any time of day (Amen). It is exciting to pay the electricity bill and be able to flip the switch and enjoy power (Amen).

HOW DOES THIS PRACTICE BENEFIT YOUR LIFE?

You may be reading this and wondering if this process is necessary. Of course, it isn’t! But I don’t like the alternative.

-

-

- Not having a plan for my money.

- Not being able to communicate with my husband with about our financial goals with specifics.

- Not being able to account for changes over time.

- Not being able to track growth or shortcomings.

-

I don’t like the alternatives.

By completing my budget intentions at the beginning of the year, I’m giving myself and my family a flexible roadmap. It may need some changes but that’s okay. I like to think of it as a financial plan for the household. We may have to pivot but our financial mission statement is the same.

Be able to account for all incoming money and outgoing expenses,

openly and honestly with specific details.

Do you have a financial mission statement?

WHERE CAN I FIND A BUDGET TEMPLATE?

I wouldn’t talk about a yearly budget template and not give you one. Duh. I created this template and a few ways for you to download it and edit it for yourself.

PDF Printable

Excel Spreadsheet

Google Sheets

I want you to give this template a try this year. If it doesn’t serve you well, okay find a different method that does but don’t walk into 2020 without budget intentions and new financial goals.

HOW MANY TIMES SHOULD I FEEL THIS OUT?

Before I leave you, I’d like to recommend that you fill out this sheet more than once.

Why? For perspective.

I filled mine out three times:

1st – I fill it out with income and expenses but the expenses usually include needs (water, electricity, etc.) and wants (salon, subscription services, gym, entertainment).

2nd- I fill it out with income and expenses but I eliminate the majority of the wants. This allows me to see how much we need to earn to take care of just the necessities.

3rd- I fill it with the things I want to manifest. I include higher income, I add activities I have not done yet (yoga, marathon), and giving opportunities. I use this as a visualization tool for my future self and I ask myself what I need to do to manifest my desires. Try it.

So often, we want more time, more money, and more freedom, but don’t have a plan with measurable goals. On my manifestation budget, I am specific about how much more money I want to earn, how much more I want to give, and the things I want to afford for the coming year. I go to God and the Universe with specifics so that there is clarity and focus. I want you to be able to do the same.

This was a long post because I am passionate about women taking control of their finances. Set your budget intentions and crush them! You can do this. I believe in you!